10 Simple Techniques For Pvm Accounting

10 Simple Techniques For Pvm Accounting

Blog Article

Little Known Questions About Pvm Accounting.

Table of ContentsWhat Does Pvm Accounting Mean?Not known Incorrect Statements About Pvm Accounting The 20-Second Trick For Pvm AccountingThe Definitive Guide to Pvm AccountingExcitement About Pvm AccountingHow Pvm Accounting can Save You Time, Stress, and Money.

Manage and take care of the development and authorization of all project-related billings to clients to promote excellent communication and prevent concerns. construction taxes. Make certain that appropriate reports and paperwork are sent to and are upgraded with the internal revenue service. Guarantee that the accountancy procedure adheres to the law. Apply needed building audit standards and procedures to the recording and reporting of construction activity.Interact with various financing agencies (i.e. Title Company, Escrow Firm) regarding the pay application procedure and requirements required for payment. Assist with applying and preserving inner monetary controls and treatments.

The above declarations are meant to define the general nature and level of work being done by individuals designated to this classification. They are not to be construed as an extensive checklist of obligations, responsibilities, and skills needed. Employees might be required to perform tasks beyond their normal duties from time to time, as required.

Pvm Accounting for Beginners

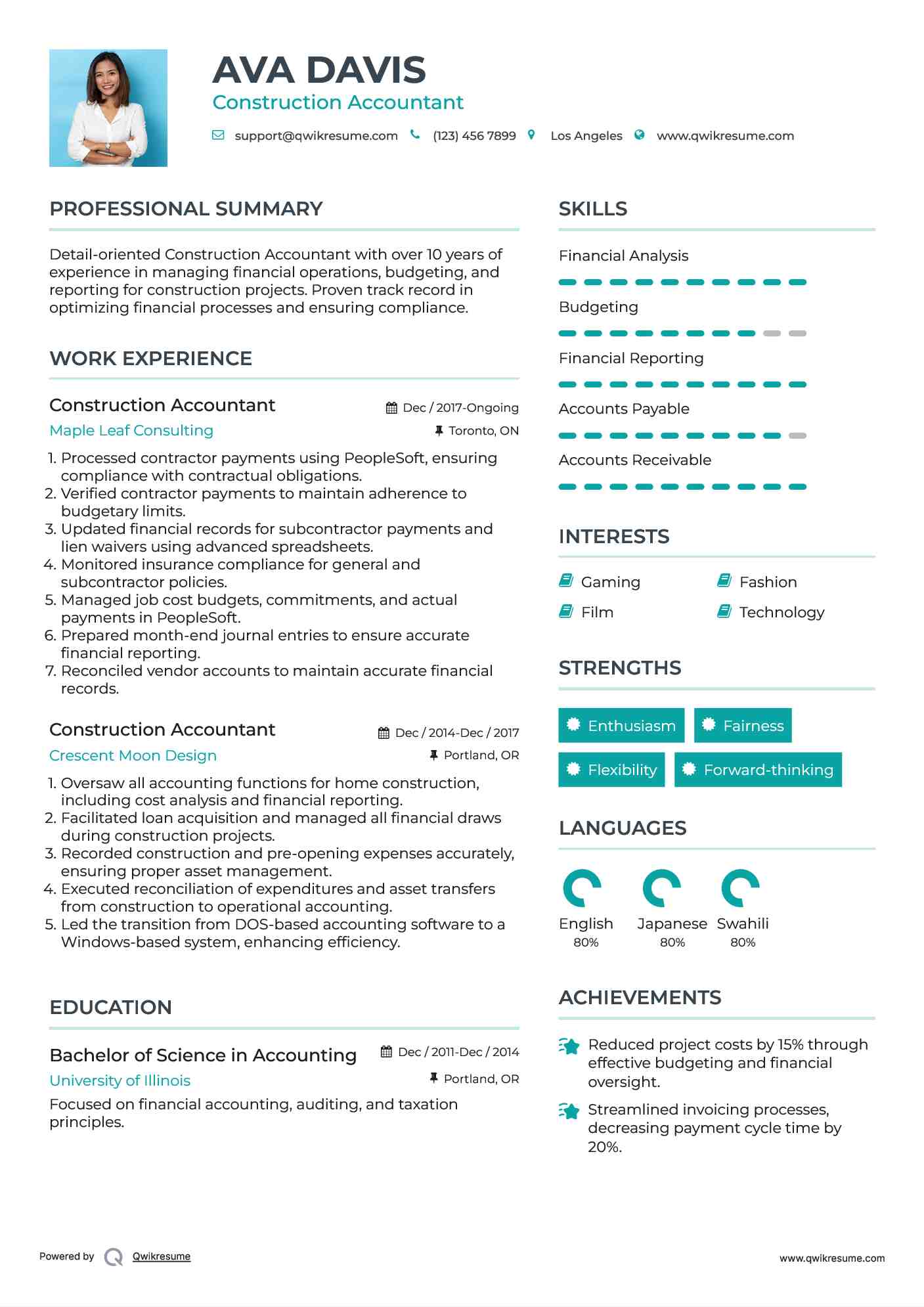

Accel is looking for a Building and construction Accountant for the Chicago Workplace. The Building and construction Accounting professional does a range of accounting, insurance conformity, and job management.

Principal tasks include, but are not limited to, handling all accounting functions of the business in a prompt and accurate manner and offering records and routines to the company's certified public accountant Firm in the preparation of all monetary declarations. Guarantees that all bookkeeping treatments and functions are managed properly. Liable for all monetary records, pay-roll, financial and day-to-day operation of the accountancy feature.

Functions with Project Supervisors to prepare and publish all month-to-month billings. Generates month-to-month Job Cost to Date records and working with PMs to fix up with Project Supervisors' budgets for each project.

Pvm Accounting Can Be Fun For Everyone

Proficiency in Sage 300 Building And Construction and Property (formerly Sage Timberline Workplace) and Procore building monitoring software a plus. https://www.figma.com/design/pEGqwVkdxaWH6r5PgQiEyD/Untitled?node-id=0%3A1&t=BbE3XCPdNiLo7e15-1. Must additionally be proficient in various other computer software program systems for the preparation of reports, spread sheets and other accountancy evaluation that might be needed by administration. construction bookkeeping. Have to have solid organizational skills and capability to focus on

They are the monetary custodians who make sure that building and construction tasks continue to be on budget, abide by tax obligation laws, and keep monetary transparency. Building and construction accounting professionals are not just number crunchers; they are critical companions in the building procedure. Their primary function is to take care of the monetary elements of building projects, the original source making sure that sources are alloted effectively and financial risks are minimized.

The 15-Second Trick For Pvm Accounting

By keeping a limited grip on job financial resources, accounting professionals assist stop overspending and economic problems. Budgeting is a cornerstone of successful construction projects, and construction accountants are crucial in this regard.

Browsing the complex internet of tax obligation regulations in the building and construction market can be difficult. Building accounting professionals are well-versed in these guidelines and guarantee that the job complies with all tax obligation needs. This consists of handling pay-roll taxes, sales taxes, and any type of other tax obligation commitments specific to building. To master the role of a building and construction accounting professional, individuals need a solid instructional structure in bookkeeping and financing.

In addition, accreditations such as Licensed Public Accountant (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Building Market Financial Expert (CCIFP) are highly pertained to in the market. Construction tasks usually include tight target dates, altering regulations, and unanticipated costs.

Things about Pvm Accounting

Expert accreditations like CPA or CCIFP are also very advised to demonstrate competence in building and construction audit. Ans: Building and construction accounting professionals produce and keep track of budget plans, identifying cost-saving opportunities and ensuring that the task remains within budget. They also track expenditures and projection financial needs to stop overspending. Ans: Yes, building and construction accounting professionals handle tax conformity for construction tasks.

Introduction to Building Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building firms have to make hard choices among many monetary choices, like bidding on one job over an additional, choosing funding for materials or devices, or establishing a project's revenue margin. In addition to that, construction is an infamously unpredictable industry with a high failure price, slow-moving time to payment, and inconsistent money circulation.

Manufacturing entails repeated procedures with conveniently identifiable expenses. Manufacturing requires different procedures, products, and equipment with differing prices. Each project takes location in a brand-new area with varying website problems and special challenges.

Getting The Pvm Accounting To Work

Resilient partnerships with suppliers reduce arrangements and boost performance. Irregular. Constant use various specialized service providers and suppliers affects efficiency and cash flow. No retainage. Payment arrives in full or with regular payments for the complete agreement quantity. Retainage. Some section of settlement might be held back up until job completion even when the contractor's job is finished.

While standard producers have the benefit of controlled settings and optimized production procedures, building companies have to continuously adjust to each new job. Also rather repeatable projects need alterations due to site conditions and other variables.

Report this page